Below I will certainly discuss this essential rule for termination notices and exactly how it is used by Michigan courts. vehicle insurance.

insurance company cars vehicle insurance credit

insurance company cars vehicle insurance credit

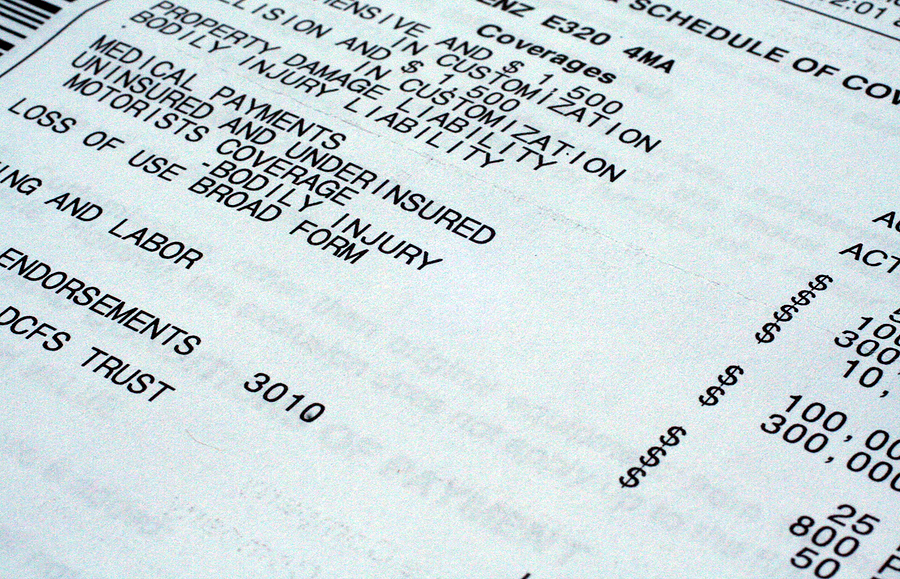

On October 9, 2017, Everest had sent out Wesley Yang a notice of cancellation, informing Yang that if he really did not pay his premium by October 26, 2017, then his policy and insurance coverage would certainly be cancelled the following day. Yang didn't make the settlement. cheap car insurance. Ultimately, Yang and his better half were harmed in an auto accident on November 15, 2017, for which they sued for No-Fault benefits with Everest - money.

cheaper car insurance prices laws low cost

cheaper car insurance prices laws low cost

3020 or its plan needed it to wait on nonpayment of premium before it could correctly send a notification of cancellation. cheapest. We disagree. For the factors reviewed listed below, Everest's preemptive cancellation notification to Yang did not constitute a notification of termination under MCL 500 (vehicle insurance). 3020(b)( 1 )." "The majority of appellate courts [in other states] that have addressed this issue have held that a notification of termination is inadequate when sent out before the superior repayment is due." "For a cancellation to take place, the event triggering the right to terminate must have occurred first.

Therefore, it is only after the nonpayment that the insurance company may effectively alert the insured of termination - liability. Simply put, the legislation for vehicle insurance cancellation for non-payment states it is not adequate that the insurance provider caution the guaranteed that a future failing to pay the costs will result in termination; instead, it has to suggest the guaranteed that, due to the fact that of an already-occurred failing to pay, the policy will be terminated in 10 days." "Altogether, issuance of a notice of termination necessarily requires that the grounds for cancellation have actually happened prior to the notice is issued.

We see no basis in conclusion that the Legislature meant to depart from that average definition and also to enable insurance firms to supply the statutorily needed notification on the plain possibility that the insured might not make a superior payment. For those reasons, we hold that a notification of termination sent out prior to the moment for making the superior repayment has actually passed does not please MCL 500.

This means waiting up until nonpayment has actually occurred prior to sending out a "notification of termination" in an initiative to cancel a policy and, hence, leave an individual without insurance coverage in case of a crash. insurance. This additionally suggests that a threatened cancellation for non-payment is not legitimate unless the person has gotten a composed notice of "not less than 10 days (vehicle insurance).".

The Greatest Guide To Car Insurance Lapse & Grace Periods Explained - Progressive

(You may get approved for other reasons (insured car).) If your coverage ends because of non-payment and you aren't signed up in Industry coverage in mid-December of that year, you aren't qualified to be automatically re-enrolled for the list below year (vehicle). When you use and also are located eligible to enlist in an Industry plan, you might be able to register in the very same plan you shed if it's still offered. cheap auto insurance.

cheap insurers affordable car insurance insurance

cheap insurers affordable car insurance insurance

cars insurance affordable affordable car insurance cheap insurance

cars insurance affordable affordable car insurance cheap insurance

Whether you select a brand-new plan or the plan you were ended from, you should pay your first month's premium to the insurer to finish your registration.

[s. car insurance. 631. 36 (2) (c), Wis. Stat. ] Renewal on Modified Terms, Sometimes an insurance company will renew a plan Will certainly raise the prices or make the terms much less desirable to the insured. An insurance company may not alter regards to coverage until 60 days (45 days for personal lines home and also casualty plans) after a notice is sent by mail to you.

If the notice is offered much less than 60 days prior to the renewal day, the brand-new terms or premium rise will not become efficient till 60 days (45 days for individual lines property and casualty plans) have actually expired from the date the notification is offered - cheapest auto insurance. These conditions do not use if the only change is a price boost of much less than 25%. auto insurance.

631. 36 (5 ), Wis. Stat. ] Nonrenewals Nonrenewal of a policy refers to the termination of a policy at the expiry date. cheaper car. If an insurer determines it does not intend to renew your plan, it has to send by mail or provide to you a nonrenewal notice at the very least 60 days before the policy's expiry date.

631. Stat. automobile.

Facts About Why Car Insurance Policies Are Canceled - Esurance Uncovered

36 (4 ), Wis. Stat. - For health insurance policy plans, it is not less than 7 days for regular costs policies, not less than 10 days for month-to-month costs policies, and not less than 31 days for Find out more all other policies.